“After over half a century of contact with the Romans, his people had become perhaps one degree less bestial than at their first arrival; but the vast majority still lived and slept in the open, disdaining all agriculture and even cooked foods – though they would often soften raw meat by putting it between their thighs and their horses’ flanks as they rode. For clothing they favoured tunics made, rather surprisingly, from the skins of fieldmice, crudely stitched together; this they wore continuously, without ever removing them, until they dropped off of their own accord. And as they had always done, they still practically lived on their horses, eating, trading, holding their councils, even sleeping in the saddle.”

The Huns were a savage tribe which smashed their way out of the Central Asian steppes around 376AD. Attila the Hun, “the scourge of God”, led a series of attacks on the Byzantine Empire and built up a vast dominion stretching from Constantinople to the Balkans in the East to Italy and France in the West. He came within a whisker of invading Rome itself.

The Hun invasion is just one example of the incursions and travails that beset the Byzantine Empire during the period covered in this book, 300 to 800AD.

This colourful account by John Julius Norwich tells the story of the early Byzantine Empire, established by Emperor Constantine I (“Constantine the Great”) in 311 AD in the new city of Constantinople on the banks of the River Bosphorus. The New Rome.

Whilst the Pope, and hence the religious centre, of the Roman Empire continued to be seated in Rome, the political centre had now gravitated towards the East.

It was not a smooth and unambiguous transition, and often there were

Co-Emperors, one for Byzantium and one for the West of the Roman Empire.

However, throughout the period of this volume, there was one inalienable and unargued article of faith for every Byzantine (and from which they drew strength of unity in times of turmoil), namely that the Emperor (or Co-Emperor) was the sole Vice-Gerent of God on earth. This volume ends with the shattering of that practice in the most remarkable way in the year 800AD. Pope Leo III produces a document (proved to be fraudulent only several centuries later) entitled the “Donation of Constantine”, pursuant to which Constantine the Great had allegedly, 500 years earlier, “retired” to the “province” of Byzantium, having bestowed on the Pope the right to confer the title of Emperor.

By this document the Frankish ruler Charles (“Charlemagne”) was crowned

Emperor by Pope Leo and despatched to Byzantium to replace the supposed Empress Irene whose reign over Byzantium had been an economic and political

disaster.

Of course, the transition was helped by another factor: “That the Empress was notorious for having blinded and murdered her own son was, in the minds of both Leo and Charles, immaterial: it was enough that she was a woman. The female sex was known to be incapable of governing, and by the old Salic tradition was debarred from doing so.”

In between the bookends of Constantine the Great and Charlemagne, we read of a fascinating period of Christian history. Of Emperors who were disastrous. Of others who ruled Byzantium with skill, care and competence.

For example Heraclius came to the throne in 610 AD. He introduced a new structure into the eastern side of Byzantium, organising it along military

lines:

- The part of Asia Minor (the northeast coastline running from Selifke in the Mediterranean to Rize on the Black Sea) which had recently been recaptured from the Persians was divided into four “Themes”, or regions. The choice of word was significant, because tema was the Greek word for a division of troops, thus underlining the warlike division of the region.

- Each tema was put under the governorship of a“strategos”, or military governor.

- A reserve army was maintained by providing potential soldiers with inalienable grants of land, in return for hereditary military service if called up.

- The net result was that Heraclius did not have to rely on ad hoc recruiting or on doing deals with dodgy barbarians in order to raise an army.

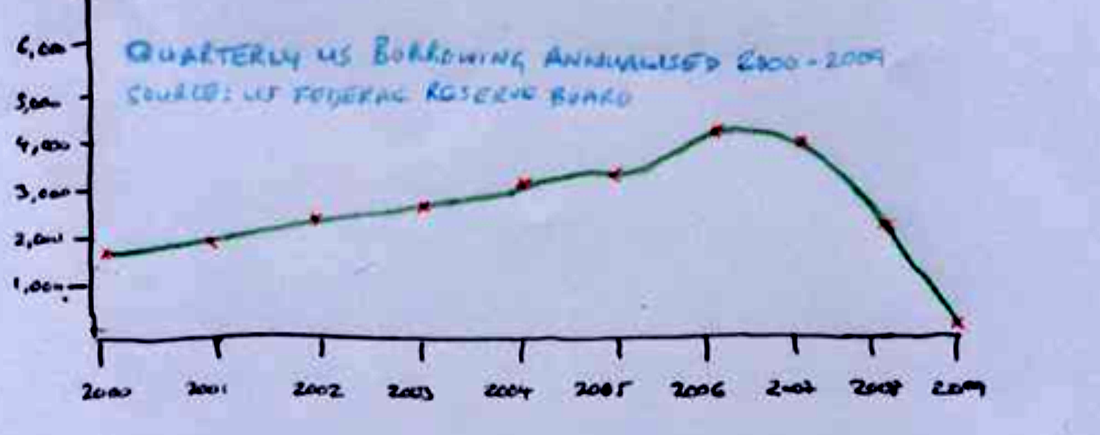

On the economic front he fixed the parlous fiscal position of the Imperial economy through:

- Taxation and government borrowing

- Restitution from supporters of the previous corrupt regime

- Subsidies from “friends and family” in Africa

- Most importantly however, he persuaded Patriarch Sergius, the Archbishop of Constantinople, to declare that the coming war would be a religious war. Hence all of the Church assets and treasure would be at the disposal of the Emperor.

Leadership 101 for aspiring modern warmongerer.

You will need to read the book to find out what became of Heraclius.

Every Emperor was confronted by tribes trying to nick territory. The Gauls and Franks perennially switching their loyalties to and from Rome. The Lombards (from modern Germany and Austria) settling in Northern Italy. The Slavs trying to take the Balkans. The Goths, the Vandals and Huns having to be bought off or fought off.

But, there are two stand-out foes of Byzantine Christendom over this period.

First, the Persian Empire, whose rulers always seemed to have the knack for knowing when they had the upper hand. As an example, in 359AD Emperor Constantius II receives a letter from the Persian King:

“Shapur, King of Kings, brother of the Sun and the Moon, sends salutation...

Your own authors are witness that the entire territory within the river Strymon and the borders of Macedon was once held by my forefathers; were I to require you to restore all of this, it would not ill-become me...but because I take delight in moderation I shall be content to receive Mesopotamia and Armenia which were fraudulently extorted from my grandfather. I give you warning that if my ambassador returns empty-handed, I shall take the field against you, with all my armies, as soon as the winter is past.”

I guess a lawyer would call that a Letter Before Action.

And of course the other formidable challenge to Byzantium was the rise of Islam.

In 633 AD, shortly after the foundation of the religion, it suddenly “burst out of Arabia.” First Damascus, then Jerusalem. Next, the whole of Syria. Egypt and

Armenia fell within the decade. The whole Persian Empire was subsumed within 20 years. And then Afghanistan and Punjab within another 10 years.

To the West, North Africa and Spain. Across the Pyrenees and finally checked

at the banks of the Loire.

The rest, as they say, is history.

The various Emperors acceded and reigned using diverse styles of governance and deployed some interesting procedural instruments.

The Emperor Maurice, though fundamentally a good man, faced financial

pressures as a result of the extravagance and incompetence of his predecessor. Around 602AD he introduced austerity measures, but went too far, at one point cutting military rations by 25%, refusing to ransom 12,000 captives of the Avars (leading to them being put to death), and decreeing that the army should not return to base for winter but should sit it out in inhospitable territory beyond the Danube. Eventually he become so unpopular that he took the decision to flee to Persia (with whose king he had previously concluded a truce), taking his family with him.

His successor Phocas, embarked on a brutal purge of all his enemies.

“Debauched, drunk, and almost pathologically cruel, he loved, we are told, nothing so much as the sight of blood..; it was Phocas who introduced the gallows and the rack, the bindings and mutilation which were to cast a sinister shadow over the centuries to come.”

First, Phocas despatched troops to Asia and killed Maurice and family. Then he exterminated his own brother and nephew. Plus a whole bunch of military men. He even managed to kill Narses, his best general in the East. Unsurprisingly, the Persians took their chance, invaded, and took

significant chunks of territory, including Mesopotamia, Syria, Armenia,

Cappadocia, Paphlagonia, and Galatia.

Other examples abound.

Julian the Apostate, who eventually became Emperor in 361 AD, had to bide his time (indeed he didn’t really have imperial designs, and in fact was a sort of travelling scholar, and by all accounts a little bit of a geek).

His cousin Constantius II preceded him as Emperor. He had had Julian’s father and stepbrother killed when Julian was a young child. Constantius made the error of elevating Julian, appointing him as the Caesar of Gaul. Julian must have had a festering hatred for Constantius II. He bided his time, and then led an army against Constantius.

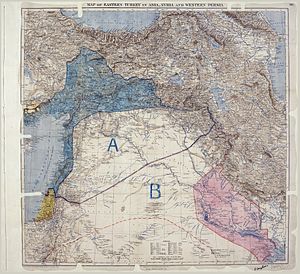

This book has some other useful features. The tables of lineages, emperors and family trees, the maps and illustration all add to understanding. Moreover there is a tourist guide, providing a list of the Byzantine monuments still surviving in Istanbul today.

I agree with the author in his Introduction that Byzantium is an era of history under-taught in schools, yet it has more than enough material to capture the imagination of a schoolchild.

The narrative of this book is tight, so it leads you swiftly from one reign to another quite seamlessly.

And that perhaps, is a clue to the central message of the book.

Dynasties come and go. Some leaders are good people, some are bad, most a bit of both. They are able to wield huge power. And yet they are all merely human beings powerless against the passage of time and events.

The wikipedia link to the book is here.

RSS Feed

RSS Feed