“Except for those few stones that have been destroyed, every diamond that has been found and cut into a jewel still exists today and is literally in the public's hands. Some hundred million women wear diamonds, while millions of others keep them in safe-deposit boxes or strongboxes as family heirlooms. It is conservatively estimated that the public holds more than 500 million carats of gem diamonds, which is more than fifty times the number of gem diamonds produced by the diamond cartel in any given year. Since the quantity of diamonds needed for engagement rings and other jewellery each year is satisfied by the production from the world's mines, this half-billion-carat supply of diamonds must be prevented from ever being put on the market.”

Edward Jay Epstein is an investigative journalist who has studied the history of

commercially-produced diamonds, and presents in this book a collection of his research, which he has been publishing in newspapers and journals since the 1980s. Indeed you can read the early chapters on Mr Epstein’s website here.

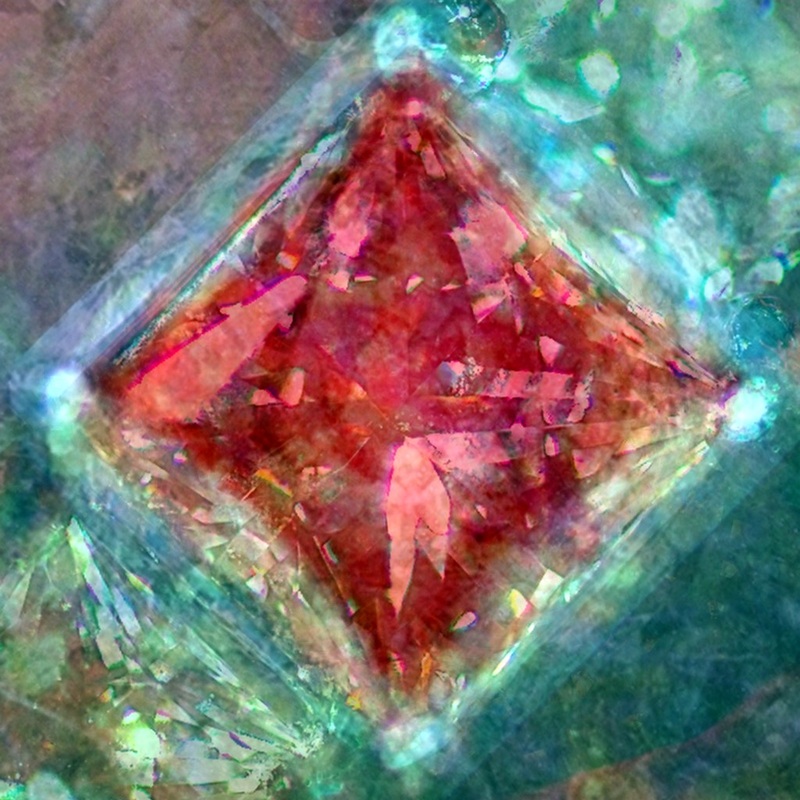

Likewise therefore, some of the supporting data and anecdotes are old, but the more recent chapters bring the reader right up to the state of play as of 2011. The central thesis of Epstein’s analysis is that diamond dealers, or wholesalers, charge extraordinary markups to retail buyers of diamonds. This markup, known as the “keystone”, can be between 100% and 200%. Hence, when you go back to a dealer to try and sell back a diamond, he may well have a slightly embarrassed look on his face, and will probably decline to quote a price, so as to preserve your dignity.

To give an example (my analysis, not from the book).

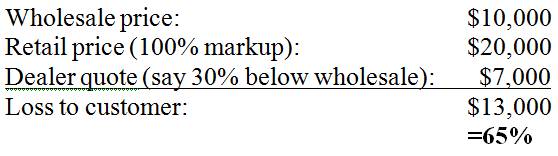

So, take the following chart, which I pulled from a website called wealthymatters here (by the way, it’s a nice little blog written by a lady based in India). The price shown is the Average One Carat D Loupe Clean wholesale diamond prices in Antwerp. Current “price” $25,000.

Epstein takes us nicely through the modern history of diamonds going back to 1870, to show how the market has been controlled. Until the late 19th century diamonds were found mostly in a few river beds in India, and in the jungles of Brazil. In 1870 however, a huge deposit was found in South Africa, near to the Orange River. In order to protect their investment the British financiers of those mines had to prevent a glut hitting the market.

Thus was created, in 1888, De Beers Consolidated Mines Ltd, incorporated in South Africa. Epstein traces the history of De Beers through the decades.

How it gained control of the whole supply chain, from production to transport to processing to marketing to distribution.

How networks were established in Europe (particularly the UK, Portugal, Belgium, Holland and Switzerland) and Israel.

Epstein provides us with vivid description of what he calls the “Diamond

Invention”:

“The diamond invention is far more than a monopoly for fixing diamond prices; it is a mechanism for converting tiny crystals of carbon into universally recognised tokens of wealth, power and romance. To achieve this goal De Beers had to control demand as well as supply. Both men and women had to be made to perceive diamonds not as marketable precious stones, but as an inseparable part of courtship and marital life.”

As the American market grew to become the largest consumer market for diamonds, it was inevitably a New York-based advertising agency, N.W. Ayer, which helped De Beers create this illusion. A huge marketing campaign was orchestrated in the post-war era to make diamonds be perceived as the only acceptable way for a man to court – and win – a woman’s affections. Movie stars, celebrities, magazine editors, and even the British Royal Family were co-opted into the campaign.

A campaign which still runs to this day.

From N.W. Ayer at the end of the 1950s:

“Since 1939, an entirely new generation of young people has grown to marriageable age. To this new generation a diamond ring is considered a necessity to engagements by virtually everyone.”

And after the Second World War new markets would open up, particularly Germany, Japan and Brazil. Epstein leads us through the new productive players in the market: Australia (brought into the fold through the creation of the Rio Tinto Corporation), and the Soviet Union (with whom a cartel deal was done).

We learn that the “blood diamonds” are, apparently, a construct to prevent the supply of “uncertified” diamonds from civil war-ridden countries like Angola and Sierra Leone. The UN Security Council, no less, has pronounced on the illegality, thus institutionalising the absence from the mainstream markets of these “blood diamonds”.

Finally, the US Anti-Trust action which culminated in the break up of the De Beers cartel in 2001, and the eventual exit of the Oppenheimer family (the owners of De Beers since 1927) from the group a few years later.

All in all a fascinating read, and enough to give humble men-folk some pause for thought next time we traipse in to acquire the sparkling “diamond invention”.

That said, try telling the story to the object of your affections, and see what she

says…

There is no Wikipedia link to the book. However, as stated much of the content appears here.

RSS Feed

RSS Feed